Scalable, Valuable & Proven

-

Even with just 6 landlords, you could manage up to 48 properties

-

Many agents manage 300–500 properties from a single branch

-

Your business becomes a valuable asset, often worth 1.5–2x annual revenue

(e.g. £150K turnover = up to £300K business value)

Why Start an Estate Agency?

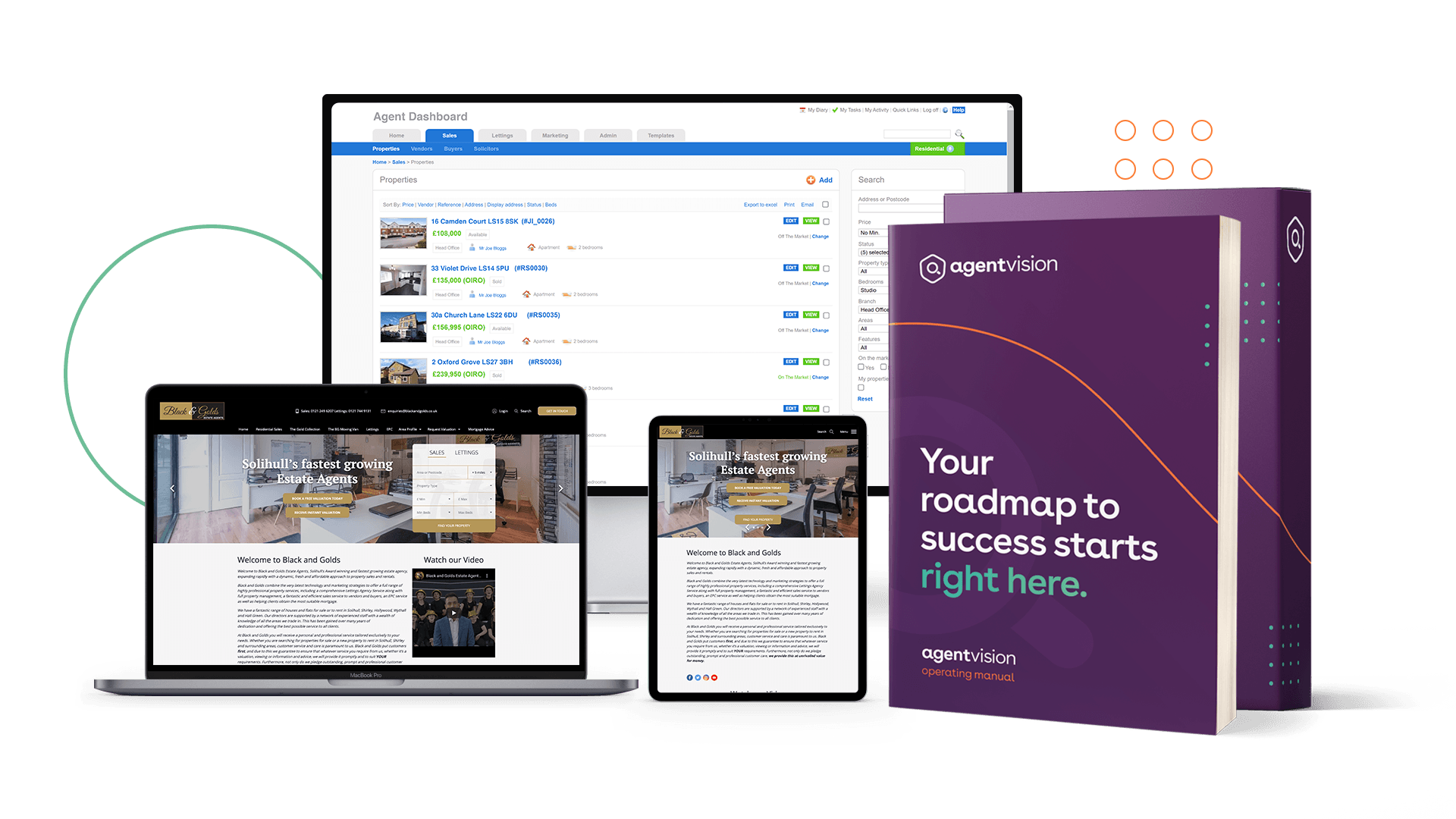

✔ Low-cost startup model

✔ Multiple income streams

✔ Ongoing support & training

✔ Free professional website

✔ Proven path to financial independence